Executive summary

- Natural capital considers how systems within our environment work together to stabilise ecosystems.

- The loss of natural capital disrupts supply chains and fuels the climate crisis, creating a cycle of escalating risk.

- Investing in natural capital breaks this cycle, treating nature as a long-term asset that builds resilience and unlocks new opportunities.

- Increased accountability to meet net-zero targets is driving companies to seek high-quality nature-based credits to offset their difficult-to-abate emissions.

- This has driven demand for credits in a market with limited supply, underscoring strong market fundamentals.

- Whilst the opportunities are clear, the nascency and, therefore, the inherent risk of nature and carbon credit markets have meant they have been relegated to philanthropy and charity.

- By focusing on maximising land potential through responsible stewardship guided by the key pillars of carbon, biodiversity, and water and prioritising financial return as well, we can transform responsible land management into a sustainable, revenue-generating model that helps unlock the significant capital required to solve the climate crisis.

The inextricable link between nature and the economy

The natural world and the global economy are deeply interconnected.

For centuries, industries – from agriculture to energy – have relied on natural resources to fuel growth. But as climate change accelerates, we must rethink how we now value and protect these essential assets.

Natural capital offers a framework that recognises nature’s value – not only as a resource but also as a foundation for planetary and economic stability. When the planet is stable, economies have the foundations to thrive.

Recent hurricanes in Florida highlight this link, with climate-driven storms causing $50 billion in damages,1 half due to increased storm intensity.2 The frequency of severe weather events has quadrupled since 1970, creating expensive disruptions worldwide.3

In fact, in 2023 alone, the world experienced 66 extreme weather events, each costing over a billion dollars, with rising temperatures making these incidents more common and severe.4

In its 2024 Client Trends Report, Aon identified weather as one of four big trends shaping the next few years.

“Changing weather is forcing organisations to manage climate risk in an increasingly holistic way – from closing the protection gap and ensuring the health and safety of workers in the face of extreme weather, to understanding regulatory changes and leveraging emerging green technologies.”

Craig Campbell, UK Head of Responsible Investment at Aon

Furthermore, Aon estimated that the direct economic cost of the physical impact of natural disasters totalled $368 billion in 2024 – 14% above the 21st-century average, according to Aon’s 2025 Climate and Catastrophe Insight. In summary and in line with the report, most, if not all, insured risks are directly or indirectly exposed to the physical or transition risks of climate change.

Aligning investment with natural resilience

The rising frequency of climate-driven disruptions signals the need for investment strategies that preserve natural resources and strengthen ecosystems. For investors, this shift offers a chance to mitigate risks while tapping into a burgeoning market with the potential for attractive returns and climate resilience.

Natural capital, as a long-term asset class, reshapes how we think about land and nature’s intrinsic value. By managing land strategically, we can create opportunities supporting environmental preservation and financial growth.

Recognising nature’s economic role

Since the first farms were established, nature has been a cornerstone of human progress. Today, over half of global GDP – roughly £44 trillion – depends on natural systems.5 But as climate impacts worsen, this dependence becomes fragile and poses risks to economic stability and communities.

In the UK, 60% of prime agricultural land is at high risk of flooding,6 and, globally, climate-related displacement could affect up to three billion people by the end of the century.7

Today, asset owners invest in land primarily for what it can provide: oil, gas, minerals, timber, or food. But as climate change and nature loss accelerate, they increasingly threaten the supply of these resources. Investments that rely on natural assets – such as food, furniture, pharmaceuticals, materials, and energy – are all at risk.

The loss of natural capital disrupts supply chains and fuels the climate crisis, creating a cycle of escalating risk. Investing in natural capital breaks this cycle, treating nature as a long-term asset that builds resilience and unlocks new opportunities.

While nature has traditionally been valued for its resources, natural capital focuses on stabilising our planet and producing a return. Protecting nature’s resilience supports environmental health and builds a foundation for economic growth.

What is natural capital?

Natural capital applies an economic lens to the world’s assets – forests, rivers, oceans, and biodiversity – creating mechanisms to value preservation and restoration. Through monetisable units like carbon and biodiversity credits, natural capital enables investors to support nature’s recovery while achieving financial returns.

“The cost of climate change is substantial, yet our natural defences are at risk. By recognising the value of protecting natural assets and channelling investment toward them, we can help achieve climate targets while mitigating long-term risks.”

Tim Currell, Partner at Aon

The three pillars of natural capital – carbon, biodiversity, and water

Most companies on the journey to net zero are reducing emissions through decarbonisation. However, residual emissions will always be difficult, if not impossible, to eliminate entirely. This is where natural solutions come in, offsetting the final portion that can’t be decarbonised.

Carbon removal credits play a key role here by economically enabling natural capital projects that actively remove carbon from the atmosphere – such as afforestation and soil carbon capture –helping to achieve true net-zero status.

While carbon reduction is often the focus of net-zero targets, natural capital goes beyond carbon sequestration. It considers how systems within our environment work together to stabilise ecosystems.

This can be divided into three pillars: biodiversity, water, and carbon sequestration. Sequestering carbon is essential, but carbon credits alone cannot be viewed in isolation. Their impact is greater when combined with efforts to protect biodiversity and improve water systems, collectively strengthening ecosystems.

Biodiversity enhances resilience, making ecosystems better able to withstand climate impacts. And healthy water systems sustain life and support agriculture.

By addressing all three pillars, natural capital investments can build long-term environmental and economic resilience.

Investing in natural capital as a route to sustainable growth

Historically, nature’s economic role has often been undervalued, often relegated to philanthropy and charity. Addressing environmental challenges requires significant capital directed towards innovative solutions.

Accountability from customers, shareholders, and employees is driving companies to meet net-zero targets. While emissions reduction through decarbonisation is critical, hard-to-abate emissions require offsetting solutions like high-quality carbon credits. This dual approach has driven demand for high-integrity credits, creating unique investment opportunities.

The limited supply of high-quality credits, coupled with rising demand, underscores strong market fundamentals. Providers of these credits address environmental and corporate accountability needs while hedging against regulatory and climate-related risks.

However, as with all markets, carbon credit investments present some risks, including price volatility, regulatory uncertainty, and verification challenges. These risks are mitigated through a focus on high-quality credits adhering to stringent standards, diversifying income streams with real estate and renewable energy, and aligning with global frameworks such as the Science Based Targets Initiative (SBTi) and the Taskforce on Scaling Voluntary Carbon Markets (TSVCM).

While natural capital’s potential is clear, it’s the practical application that truly brings it to life. Through active stewardship and innovative strategies, we can transform land into a sustainable, revenue-generating model.

Bringing natural capital to life

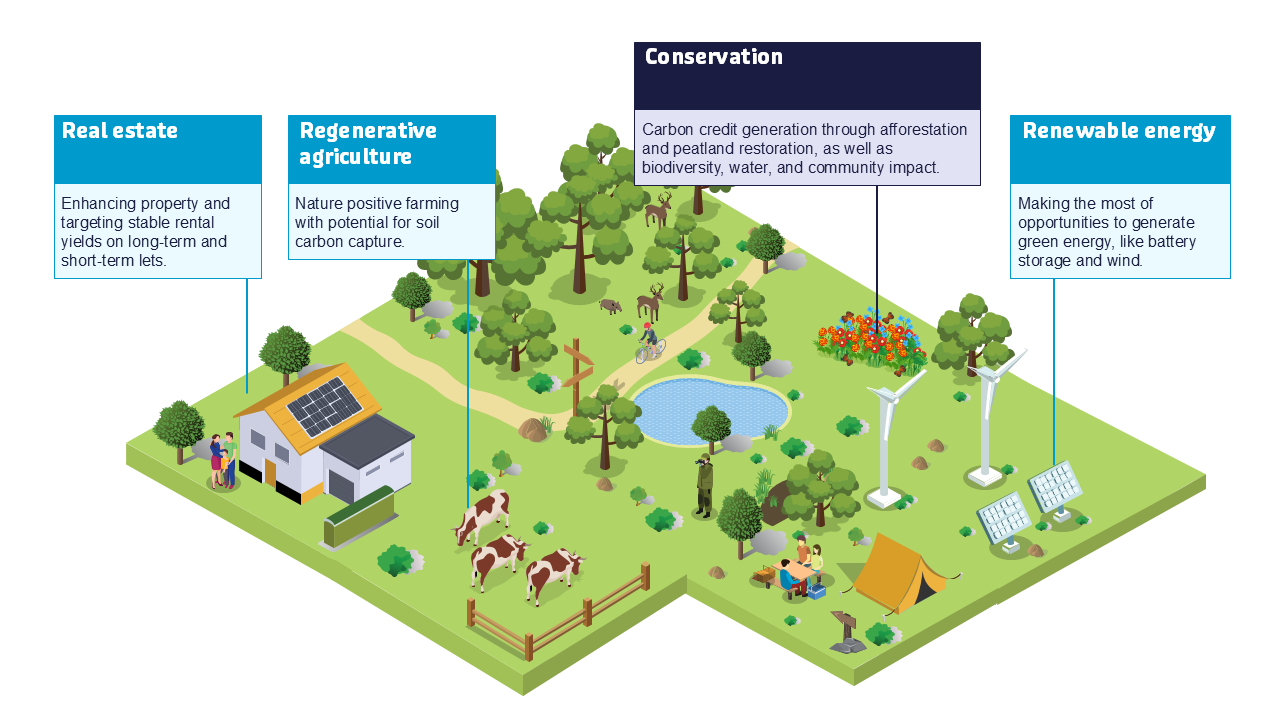

At Octopus, we focus on integrity, impact, and financial merit in our natural capital approach. Our investment strategy centres on maximising land potential through responsible stewardship, guided by those three key pillars: carbon, biodiversity, and water.

We prioritise land restoration and preservation, generating nature credits – such as carbon and biodiversity credits – alongside diverse revenue streams like property rentals, ecotourism, regenerative agriculture, and renewables. This approach supports ecosystem health while creating financial value for our investors.

“Delivering environmental and societal impact is essential to achieving a just transition to a low carbon economy, in line with the goals of the Paris Agreement. Pairing impact with sustainable land management creates potential investment opportunities for asset owners while contributing to environmental resilience and long-term financial stability. However, this is a nascent area, and asset owners should think carefully about how to capitalise on these opportunities within their wider investment strategies, objectives, and constraints, such as their investment time horizon and appetite for illiquidity.”

Craig Campbell, UK Head of Responsible Investment at Aon

Transforming land into a multi-revenue asset

To illustrate the potential of natural capital investments, consider a land restoration project that evolves into a diverse and sustainable revenue-generating model.

Here’s how we might strategically transform a large, potentially run-down estate into a sustainable, multi-revenue asset:

Initial stage: existing revenue

When purchased, an estate may generate modest income through traditional farming and property rentals. While well understood, these sources alone often fall short from both a financial and environmental perspective. We would look to implement the following:

- Nature-based solutions: Afforestation projects generate carbon credits and tree sponsorship programmes, enhancing biodiversity and delivering measurable climate benefits.

- Property restoration: Run-down or unused property on the land can be restored and repurposed for sustainable developments, such as eco-tourism lodges or energy-efficient housing. These new assets introduce additional revenue streams while maintaining the land’s ecological balance.

- Renewable energy integration: Unused portions of land can be leased to renewable developers so that solar farms or wind turbines could be installed, contributing to climate goals and adding steady income.

- Regenerative agriculture: Over time and where appropriate, we may transition conventional farming practices to regenerative models that are kinder to the environment, sequester carbon, and improve the overall quality of the soil.

The outcome: a resilient, holistic revenue model

This multi-layered approach enhances financial stability, delivers environmental resilience, and generates long-term returns for investors.

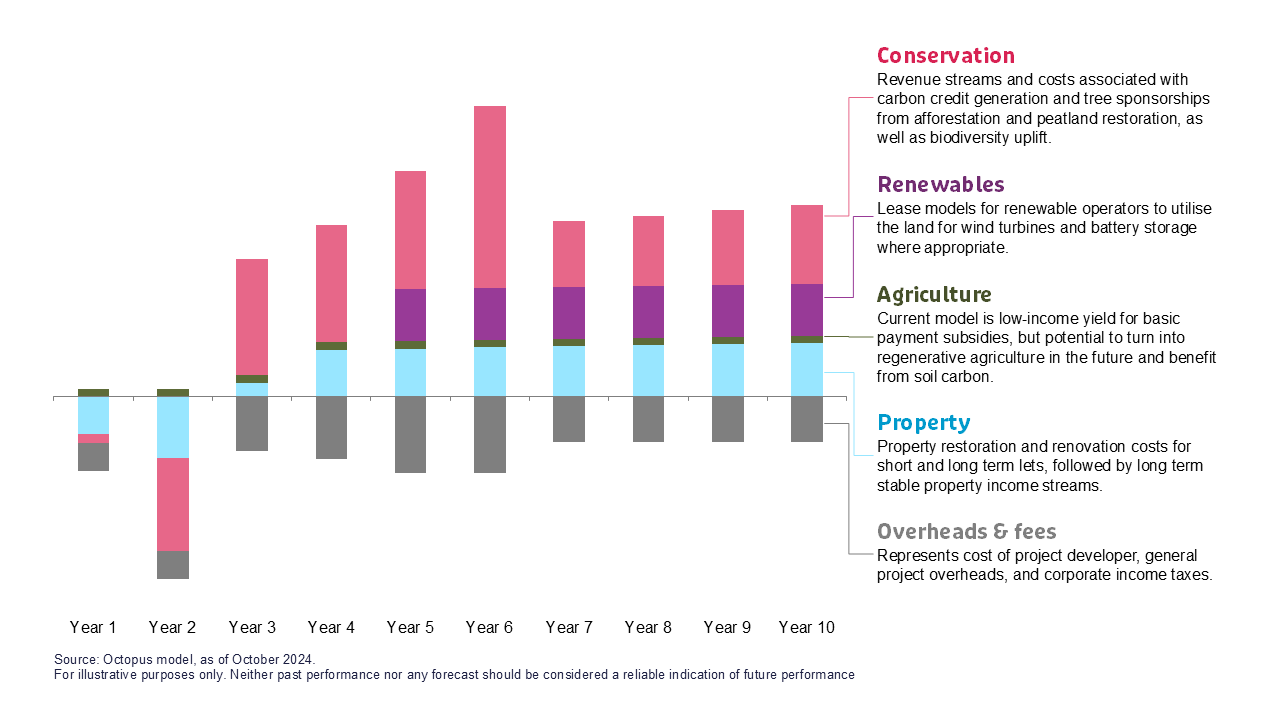

The graph below illustrates this journey, showing how an estate can transition from modest income sources to a robust, sustainable revenue model driven by carbon credits, eco-tourism, renewable energy, and more.

Starting with limited farming and rental income, the estate transforms into a diversified asset with measurable environmental, societal, and financial benefits – proof that responsible stewardship can unlock significant value for both nature and investors.

Building a sustainable future through natural capital investment

Natural capital investment offers a unique opportunity to align financial returns with environmental stewardship. By diversifying revenue streams and integrating conservation, investors can hedge against risks while contributing to a sustainable future.

Now is the time to reaffirm the relationship between nature and the economy, recognising that sustainable growth depends on preserving our natural assets.

Contact us below to join the conservation.

Interested in Natural Capital?

Talk to one of us.

If you are interested in investing into Natural Capital, we would love to hear from you.

Please fill out the form below and we will be in touch shortly to arrange a time for further discussion.

1 The Guardian – Florida in Hurricane Milton Damage

2 Imperial College London – Climate Change Behind Almost Half of Costs

3 United Nations – General Debate – General Assembly

4 Gallagher Re – Natural Catastrophe and Climate Report: 2023

5 World Economic Forum – Half of World GDP Dependent on Nature

6 CPRE – The Countryside Charity – Huge Quantities of Productive Land Lost

7 BBC – How Borders Might Change to Cope with Climate Migration